Brambles monitors its performance and value creation through a number of financial and non-financial metrics. These include:

- Like-for-like volume growth in line with economic/industry trend

- Expansion with new and existing customers

- Movements in pricing and changes in product/customer mix

- FY18 to FY20 reported financials include the impact of accounting standard AASB 15 Revenue from contracts with customer

5-Year Performance

Sales revenue of US$4,733.6 million in FY20 reflected a five-year compound annual growth rate (‘CAGR’) of 5% at fixed 30 June 2019 FX rates and excluding the impact of accounting policy changes. Growth reflects continued expansion with both new and existing customers, new market entry, expansion of the core product offering and price realisation in both mature and emerging markets in response to increased inflation and a higher cost-to-serve. FY20 growth includes the impact of Covid-19 on trading conditions, including a surge in pallet volumes in the fourth quarter, the closure of the global automotive manufacturing industry and lockdown restrictions impacting the Kegstar business. Refer to page 127 for the detailed five-year financial performance summary on a reported basis at actual FX rates.

- Transport, logistics and asset management costs (including external factors such as third-party logistics and fuel prices)

- Plant operating costs in relation to management of service centre networks and the inspection, cleaning and repair of assets (including labour costs and raw material costs)

- Other operational expenses (primarily overheads such as selling, general and administrative expenses)

- Depreciation as well as provisioning for irrecoverable pooling equipment

- FY18 to FY20 reported financials include the impact of accounting standard AASB 15 Revenue from contracts with customers

- FY20 includes a US$24.2 million benefit from new accounting standard AASB 16 Leases

5-Year Performance

Underlying Profit of US$795.0 million in FY20 reflected a five-year CAGR of (1)% at fixed 30 June 2019 FX rates and excluding the impact of accounting policy changes. While sales growth was a strong contributor to profit growth, Underlying Profit growth was below the rate of sales growth due to continued direct cost pressures in the CHEP business including high inflationary pressures, higher asset charges and increased investment across the business to support growth, network efficiencies and improved commercial outcomes. These cost pressures are offset in part through pricing actions and benefits from efficiency programmes, particularly the US Automation projects with benefits progressively delivered from FY20 to FY22. Refer to page 127 for the detailed five-year financial performance summary on a reported basis at actual FX rates.

- Profitability

- Capital expenditure

- Movements in working capital

- FY20 reported financials include the impact of new accounting standard AASB 16 Leases

5-Year Performance

The five years to FY20 were a period of solid overall EBITDA growth, supported by significant investment in capital expenditure to support growth, as well as improved working capital management and increased collections of asset compensations.

FY16 performance was impacted by a one-time change to payment processes that increased working capital, as well as increased capital expenditure to support high levels of growth in that year. The strong FY18 performance included strong working capital management initiatives and US$150 million cash inflow related to the repayment of the HFG joint venture shareholder loan. FY19 included increased capital investment to support strong top line growth and to deliver on a number of efficiency programmes.

Excluding the benefits from AASB 16, FY20 Cash Flow from Operations was US$603 million and included benefits from asset efficiency and procurement programmes, as well as favourable working capital movements. Refer to page 127 for the detailed five-year financial performance summary on a reported basis at actual FX rates.

- Underlying Profit performance

- Capital expenditure on pooling equipment to support growth in the business, which is primarily dependent on the rate of sales growth. Brambles’ main capital cost exposures are raw materials, primarily wood

- Asset control factors i.e. the amount of pooling equipment not recoverable or repairable each year (and therefore

requiring replacement) - Frequency with which customers return or exchange pooling equipment

- FY18 to FY20 reported financials include the impact of accounting standard AASB 15 Revenue from contracts with customers

- FY20 reported financials include the impact of new accounting standard AASB 16 Leases

5-Year Performance

The trend in Brambles’ ROCI metric over the five-year period reflects the Underlying Profit performance and increased Average Capital Invested, largely to support growth and supply chain efficiency initiatives including the US accelerated automation and lumber procurement programmes. Refer to page 127 for the detailed five-year financial performance summary on a reported basis at actual FX rates.

Brambles’ Zero Harm Charter states that everyone has the right to be safe at work and to return home as healthy as they started the day.

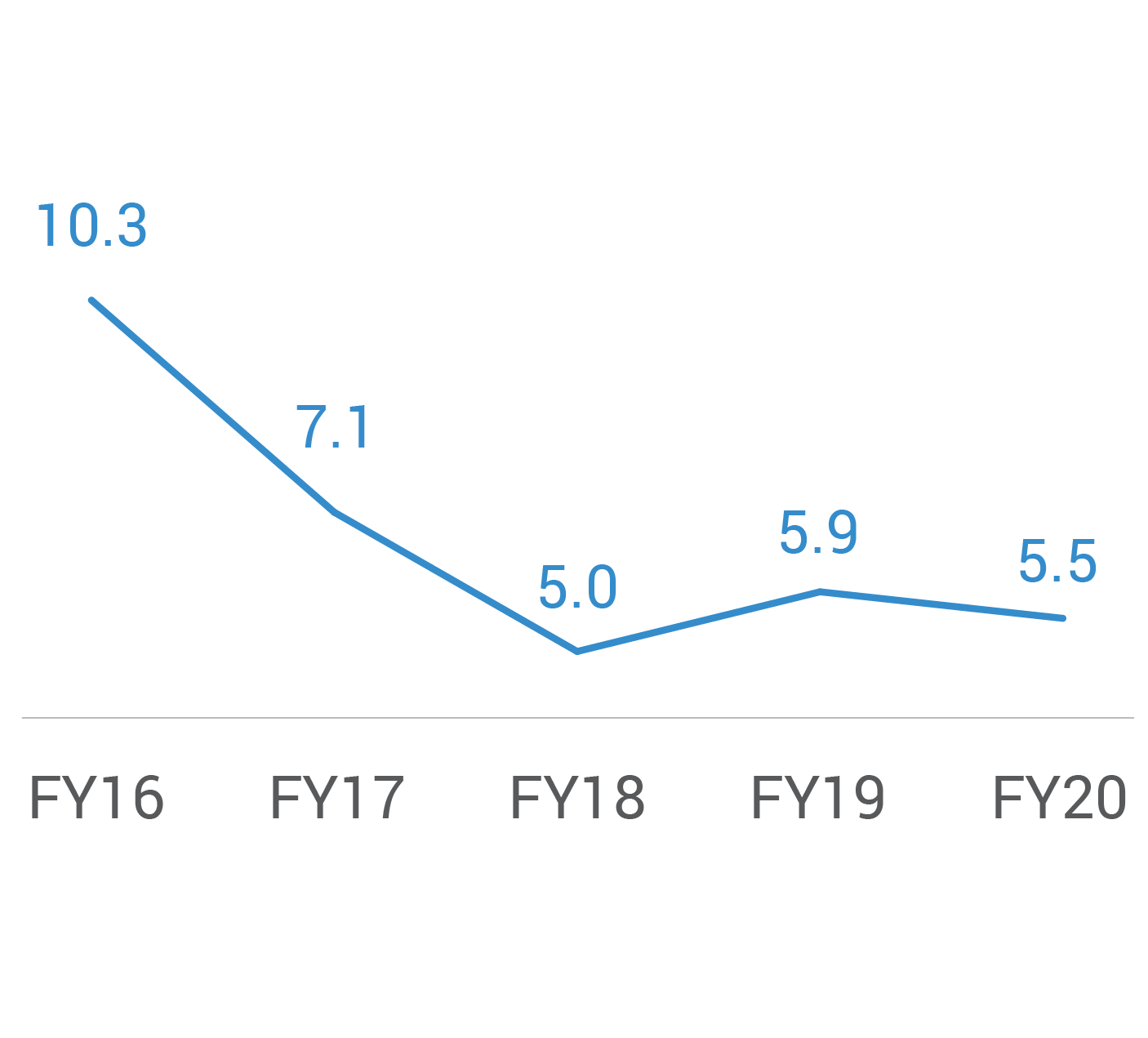

5-Year Performance

Brambles gauges its safety performance through the Brambles Injury Frequency Rate (BIFR), which measures work-related incidents resulting

in fatalities, lost time, modified duty or medical treatment per million

hours worked.

In FY20, Brambles met its year-on-year improvement target, recording a BIFR of 5.5, which represents a 61% decrease in BIFR for the five-year period ending June 2020. Brambles remains committed to the updated strategy called ‘Safety Differently’, which seeks to address the residual risks across its operations.

Brambles’ Zero Harm Charter and safety targets align with SDG 3: Good Health and Wellbeing.

Ongoing secure supply of raw materials for the production and repair

of pooling equipment, in particular wood used for pallets, is critical

to Brambles.

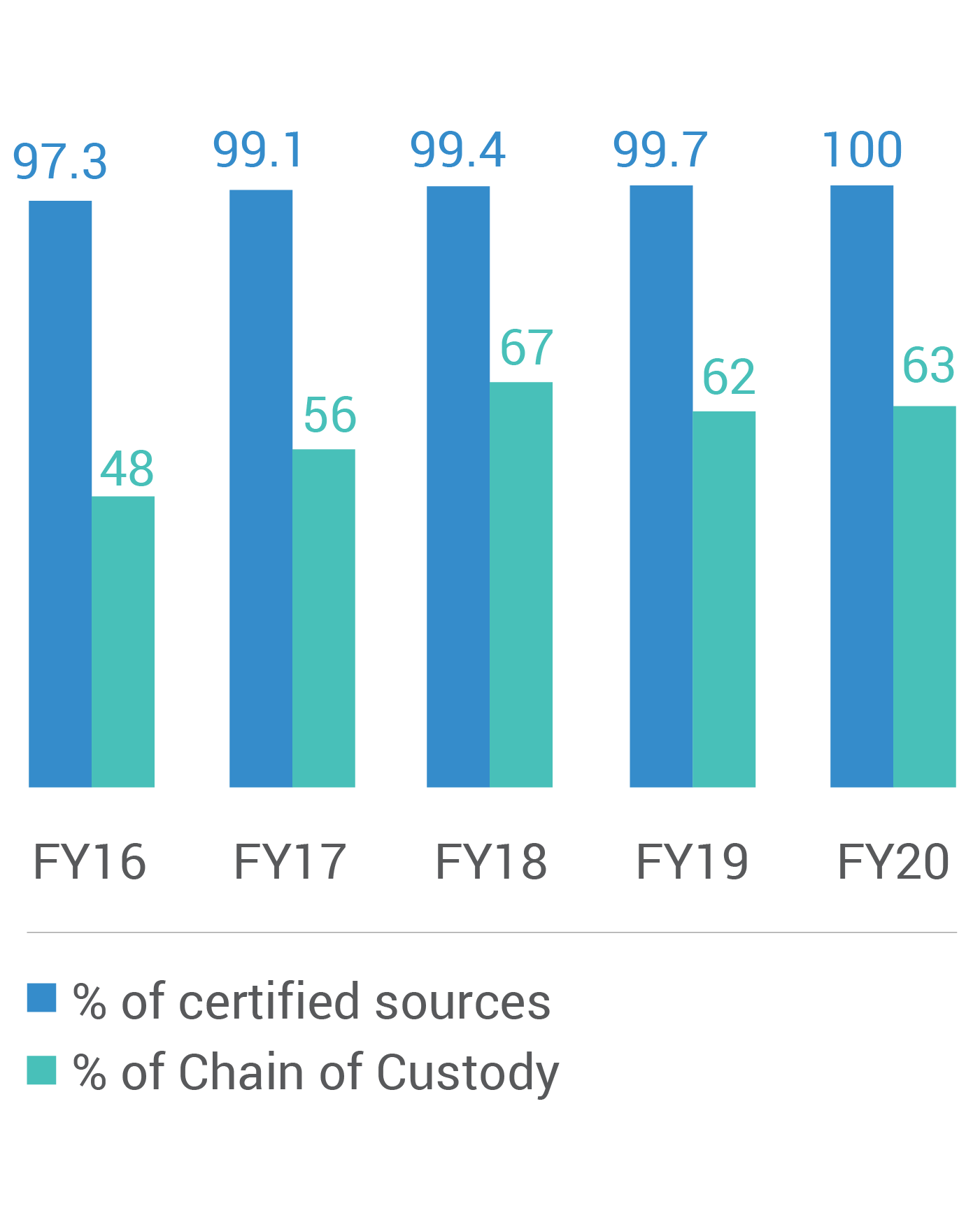

5-Year Performance

In 2015, Brambles committed to acquire 100% of its timber from certified sources by 2020. Brambles has achieved this goal, closing the remaining gap of 0.3% from the previous year.

Brambles’ sustainable sourcing efforts have helped transform forest supply chains by raising the profile of sustainable certifications and building capacity with suppliers in each region. Brambles also seeks to increase the amount of timber purchased that is covered by a full Chain of Custody (CoC) traceability, which is not currently available in all regions of operation. In FY20, CoC performance improved from 62.3% to 62.7% on 2019 results.

Looking ahead, Brambles is establishing relationships and strategic agreements with suppliers in the Americas, which will result in full certification of their supply chains by FY21. While Brambles is proud of achieving its 2020 goal, its 2025 sustainability vision will look to regenerate more forests above and beyond the benefits of the certification programmes.

This commitment will ensure the regeneration of Brambles’ most important raw material, but at the same time, support global efforts to improve and sustain small communities’ livelihoods and economies, while increasing mitigations for the impacts of climate change.

Brambles’ sustainable sourcing objectives seek to preserve and enhance the Group’s key resource dependency and are directly linked to SDG 15: Sustainable Use of the World’s Forests and SDG 13: Climate Action.