Capital Structure

Brambles manages its capital structure to maintain a solid investment grade credit rating. During FY20, Brambles held investment grade credit ratings of BBB+ from Standard & Poor’s and Baa1 from Moody’s Investors Service.

In determining its capital structure, Brambles considers the robustness of future cash flows, the potential funding requirements of its existing business, growth opportunities and acquisitions, the cost of capital, and ease of access to funding sources.

Initiatives available to Brambles to achieve its desired capital structure include: adjusting the amount of dividends paid to shareholders; returning capital to shareholders; buying back share capital; issuing new shares; selling assets to reduce debt; varying the maturity profile of borrowings; and managing discretionary expenses.

On 31 May 2019, Brambles divested its IFCO RPC business, generating net cash proceeds of US$2.4 billion and implemented an A$2.8 billion (US$1.95 billion) capital management programme. During the course of FY20, Brambles paid a special dividend totalling A$266.0 million (US$183.2 million), returned A$187.8 million (US$129.3 million) of capital to shareholders and repurchased 85.7 million shares for a total consideration of A$972.5 million (US$645.4 million). The ‘Capital Management Programme’ section on page 9 further outlines the progress of the capital management programme.

Treasury Policies

Key treasury activities include: liquidity management; interest rate and foreign exchange risk management; and securing access to short- and long-term sources of debt finance at competitive rates. These activities are conducted on a centralised basis in accordance with Board policies and guidelines, through standard operating procedures and delegated authorities.

These policies provide the framework for the treasury function to arrange and implement lines of credit from financiers, select and deal in approved financial derivatives for hedging purposes, and generally execute Brambles’ financing strategy.

The Group uses standard financial derivatives to manage financial exposures in the normal course of business. It does not use derivatives for speculative purposes and only transacts derivatives with relationship banks. Individual credit limits are assigned to those relationship banks, thereby limiting exposure to credit-related losses in the event of non-performance by any counterparty.

Funding and Liquidity

Brambles generally sources borrowings from relationship banks and debt capital market investors on a medium-to-long-term basis.

Bank borrowing facilities were either maintained or renewed throughout the Year. These facilities are generally structured on a multi‑currency, revolving basis with maturities ranging to 2025. Borrowings under the facilities are floating-rate, unsecured obligations with covenants and undertakings typical for these types of arrangements. Borrowings are also raised from debt capital markets by the issue of unsecured fixed interest notes, with interest paid either annually or semi-annually. At balance date, loan notes on issue totalled US$1,637 million and had maturities out to October 2027.

As at 30 June 2020, Brambles held $0.8 billion in cash and cash equivalents and term deposits, being the balance of cash held from the net proceeds from the sale of IFCO reduced by the capital management and debt reduction transactions over FY20.

Net Debt and Key Ratios

| US$m | June 2020 | June 2019 | Change |

|---|---|---|---|

| Current debt8 | 149.1 | 556.8 | (407.7) |

| Non-current debt8 | 2,368.6 | 1,643.4 | 725.2 |

| Gross debt | 2,517.7 | 2,200.2 | 317.5 |

| Less: cash and cash equivalents | (737.3) | (1,691.3) | 954.0 |

| Less: term deposits | (68.6) | (411.2) | 342.6 |

| Net debt | 1,711.8 | 97.7 | 1,614.1 |

| Key ratios9,10 | FY20 | FY19 | |

| Net debt to EBITDA | 1.10x | 0.08x | |

| EBITDA interest cover | 19.3x | 14.6x |

With the adoption of lease accounting standard AASB 16 on 1 July 2019, Brambles’ revised its financial policy to target a net debt to EBITDA ratio of less than 2.0 times, which was previously less than 1.75 times.

The ratios remain well within the financial covenants included in Brambles’ major financing agreements, which exclude the impact of AASB 16.

8 FY20 current debt comprises current borrowings (US$36.3m) and current lease liabilities (US$112.8m). FY20 non-current debt comprises non-current borrowings (US$1,777.2m) and non-current lease liabilities (US$591.4m).

9 Brambles has redefined EBITDA as Underlying Profit adding back depreciation, amortisation and Irrecoverable Pooling Equipment Provision (IPEP) expense. FY19 comparative metrics are as reported at the FY19 result.

10 FY20 ratios include the impact of lease liabilities and lease interest expense.

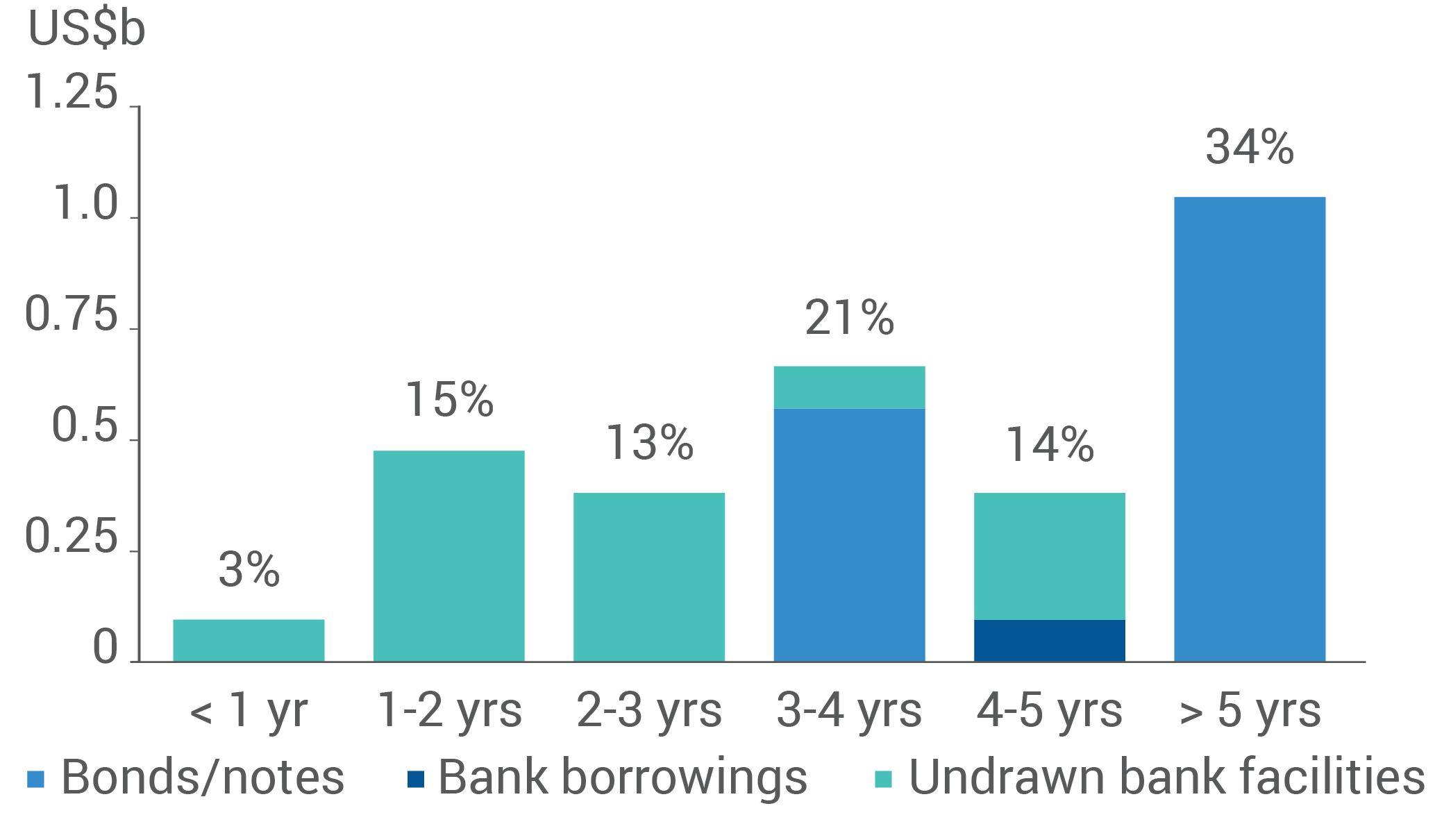

Maturity Profile of Committed Borrowing Facilities and Outstanding Bonds (% of total committed credit facilities)

As at 30 June 2020, Brambles’ total committed credit facilities were US$3.1 billion.

The average term to maturity of Brambles’ committed credit facilities as at 30 June 2020 was 4.2 years (2019: 4.0 years).

In addition to these facilities, Brambles has entered into leases for office and operational locations and certain plant and equipment to achieve flexibility in the use of its assets. As at 30 June 2020, Brambles’ total lease liabilities were US$0.7 billion. The rental periods vary according to business requirements.