| Macro-economic conditions |

Macro-economic conditions, or economic conditions affecting the supply chain or industries in which Brambles’ customers operate, may affect demand for Brambles’ services and/or its financial performance |

- Continued focus on driving growth through investment in expanded customer value proposition, targeted diversification in opportunities with attractive long‑term characteristics and the adoption of plant and automation project in CHEP Americas

- Adoption of pricing and cost-recovery strategies to mitigate the impact of cost inflation

|

|

Industry trends in the retail, grocery and consumer goods supply chains

|

Industry trends (e.g. fragmentation of the retail supply chain, growth of e-commerce and hard discounters, demand for different pooling equipment materials or designs) could affect demand for Brambles’ current service offerings, the value of its existing assets, and/or its financial performance |

Ongoing programmes to:

- Drive customer intimacy throughout the supply chain and uncover opportunities to leverage the Group’s unique global scale and value proposition

-

Create new products and service lines to meet customers’ requirements

|

| Maintaining the quality of pooled equipment in line with customer needs |

A failure to maintain adequate quality standards may result in reduced customer satisfaction, additional costs and affect the Group’s financial performance

|

- Strict adherence to equipment quality standards, including continuous monitoring of critical-to-quality metrics to assess and ensure quality of products issued to customers

|

|

Maintaining control of pooling equipment

|

The loss of pooled equipment is inherent in Brambles’ business model. Failure to maintain appropriate asset control and recovery processes may result in additional costs and affect the Group’s financial performance |

- Dedicated asset control teams across all business units and the creation of a comprehensive system of processes to increase the timely collection of assets

- Regular schedule of customer equipment inventory audits to assess key asset recovery metrics and identify potential control issues

|

|

Network capacity

|

The scale and strength of Brambles’ network of service centre locations is inherent to its value proposition for customers and other stakeholders. A lack of capacity within the network in a major market could adversely impact service delivery, competitive position and financial performance |

- Adoption of the plant automation project in CHEP Americas and plant network optimisation projects in major markets

|

| Competitors |

Brambles operates in competitive markets. Increasing intensity of competitor activity could affect Brambles’ market penetration and financial performance

|

- Leverage Brambles’ unique global scale, network advantage and sustainable business model to deliver customer value and strengthen relationships

- Adoption of an innovation programme to enhance existing/ develop new products and services

- The establishment of BXB Digital to explore the role of technology in Brambles’ business and customer offering and to engage in innovation of products and services in the digital space

|

|

Retailer acceptance of pooled solutions

|

Retailers are integral to Brambles’ operating model. A reduction or loss of retailer support for pooled solutions in their supply chains could result in a loss of customers and/or market penetration and adversely impact Brambles’ financial performance |

- Dedicated teams with executive-level responsibility for strengthening retailer relationships, identifying retailer-specific product requirements and ensuring retailers understand Brambles’ value proposition

-

Improving the value proposition for retailers through the implementation of joint business plans

- Implementation of programmes to facilitate manufacturer advocacy of Brambles’ pooled solutions

|

| Cyber security |

The unauthorised access to or use of Brambles’ IT systems could adversely impact Brambles’ ability to serve its customers or compromise customer or employee data, resulting in reputational damage, financial loss and/or adverse operational consequences |

- Brambles has implemented an IT security strategy which utilises technologies and processes to protect systems and to detect and promptly respond to unauthorised or inappropriate activities. These controls include, but are not limited to, e-mail and internet filtering, anti-virus software, multi-factor authentication, dedicated security architect personnel, security awareness and training, as well as the use of penetration testing across its network

- Brambles uses the National Institute of Standards and Technologies Cyber Security Framework to monitor, track, and report progress to senior management

|

|

IT data governance

|

Brambles relies on its IT systems, and the data stored on those systems, to operate its business. The identification and classification of Brambles’ key data assets is a key component of its capacity to effectively carry on its businesses and to its cyber security strategy. The proper identification and classification of data assets allows Brambles to prioritise security technology implementations that offer targeted and appropriate protection. Incomplete or unsuitable identification and classification of key data assets could result in the misuse, loss of or unauthorised access to sensitive data due to incorrect storage, processing or disposal procedures. This, in turn, could result in financial loss, operational disruption and/or reputational damage

|

- During the Year, Brambles adopted a Data Classification and Handling Policy supported by mandatory training. The policy includes guidelines on the types of data and protection protocols for each type

- Preventative controls are also in place to mitigate the risk of loss or misuse of data. These controls include the encryption of laptops, e-mail data retention controls and the ability to store data in secure drives

|

| Hard Brexit |

During the Year, the risk of the United Kingdom exiting the European Union (EU) without reaching an agreement with the EU on the terms of that exit (known as a “Hard Brexit”) has increased. A Hard Brexit could result in Brambles incurring increased capital and operating expenses relating to asset efficiency, heat treatment of pallets, raw materials, transport and customers’ clearance costs as well as disruption to both Brambles’ and its customers’ businesses in Europe

|

- In FY18, Brambles established a Brexit Taskforce reporting to a Brexit Steering Group to identify risks associated with Brexit and steps which should be taken to mitigate those risks

- Mitigation plans have been put in place and, where necessary, budgeted for, to manage those risks

|

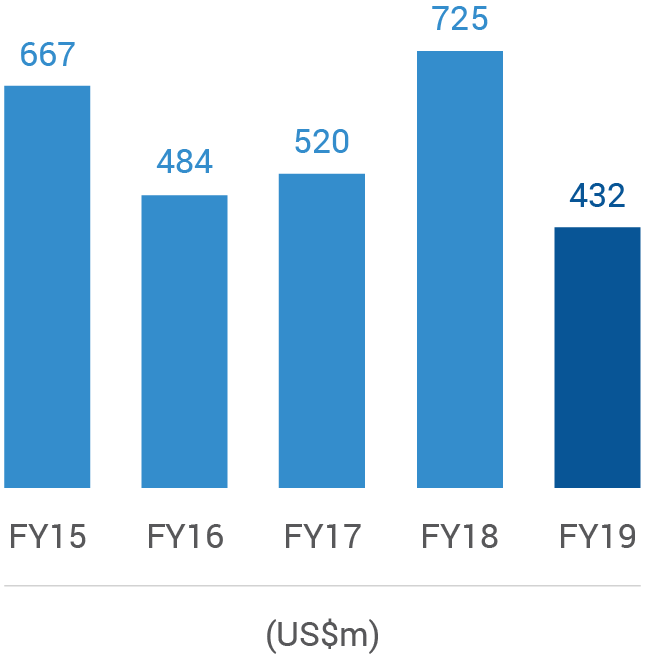

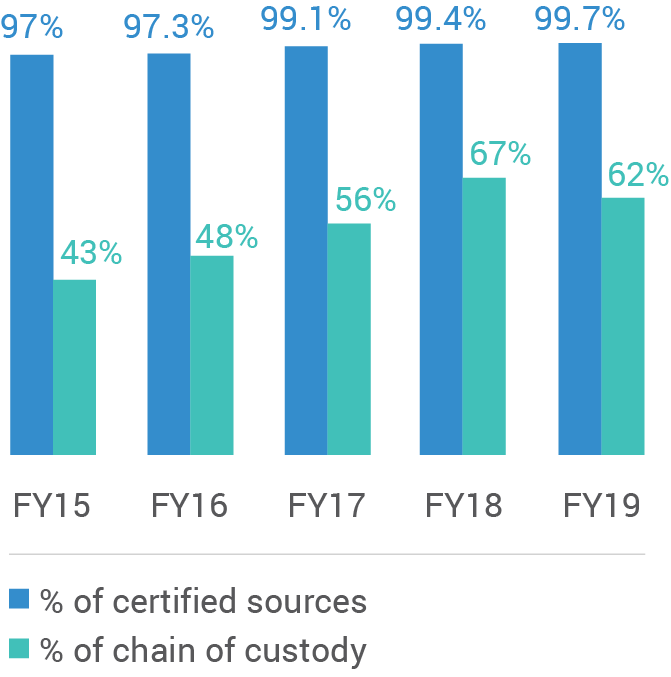

| Timber Supply |

Access to sustainably certified sources of timber is essential for Brambles to carry on its businesses. A concentration of timber suppliers in any region, or a shortage of available certified sources of timber, could adversely impact Brambles’ ability to maintain its timber pallet pool at levels that will enable it to meet customer demand for those products. This could result in loss of customers and/or market penetration and adversely impact Brambles’ financial performance

|

- Adoption of regional and global dedicated timber procurement teams to manage timber procurement and to mitigate timber supply risks

|

|

Regulatory compliance

|

Brambles operates in a large number of countries with widely differing legal regimes, legislative requirements and compliance cultures. A failure to comply with regulatory obligations and local laws could adversely affect Brambles’ operational and financial performance and its reputation |

- A Code of Conduct which provides a framework for detailed policies addressing regulatory compliance

- Adoption of Group-wide online compliance training programmes to supplement face-to-face training

- Dedicated Chief Compliance Officer responsible for monitoring the implementation and ongoing application of compliance management systems

|

|

Attraction and retention of talent

|

A failure to attract, develop and retain high performing individuals could adversely impact Brambles’ ability to implement and manage its strategic objectives |

- Detailed talent management and succession planning processes to identify high potential employees and prepare successors for senior executive positions

- Adoption of development programmes for management, leadership and functional expertise through all employment levels

- Formal mentoring programmes offered to all employees

|

|

Digital disruption

|

The development of cost effective digital supply chain solutions has the potential to materially change supply chain dynamics. If a third party were to develop such solutions before Brambles, it could adversely impact Brambles’ business models. This could result in loss of customers and/or market penetration and adversely impact Brambles’ financial performance

|

-

Brambles is innovating, developing, testing and refining digital solutions which have the potential to provide commercial digital services to its customers and to assist its businesses to more effectively and efficiently manage equipment losses and asset efficiency

|

| Safety |

Brambles is subject to inherent operational risks, including industrial hazards, road traffic or transportation accidents, that could potentially result in serious injury or fatality of employees, contractors or members of the public

|

- A Zero Harm Charter, which states that everyone has the right to be safe at work and to return home as healthy as they started the day

- Safety management systems adopted at all workplaces

-

Use of safety metrics which measure work-related injuries, lost time, modified duties and incidents requiring medical treatment

- Regular reporting and monitoring by the Brambles Board

|