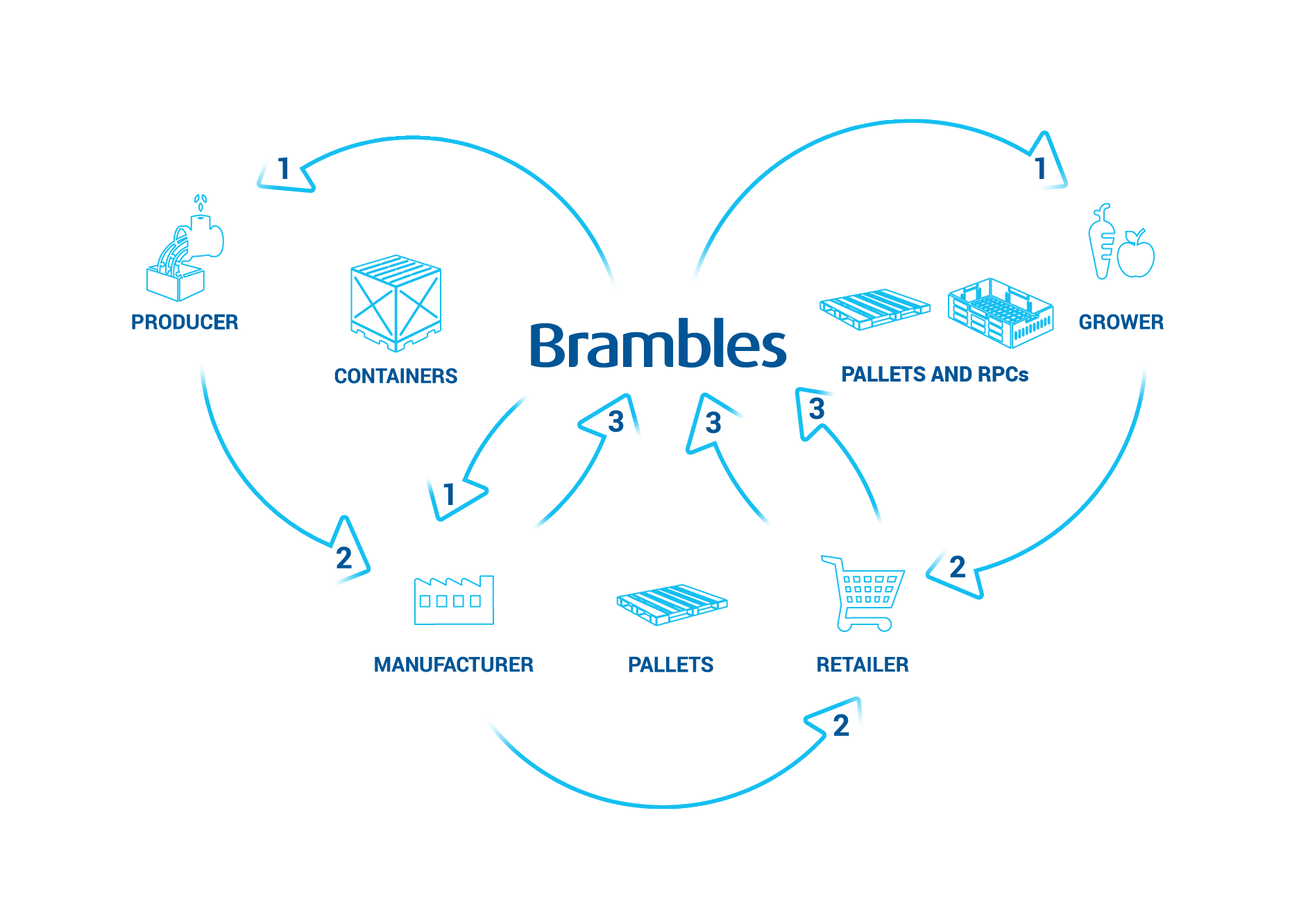

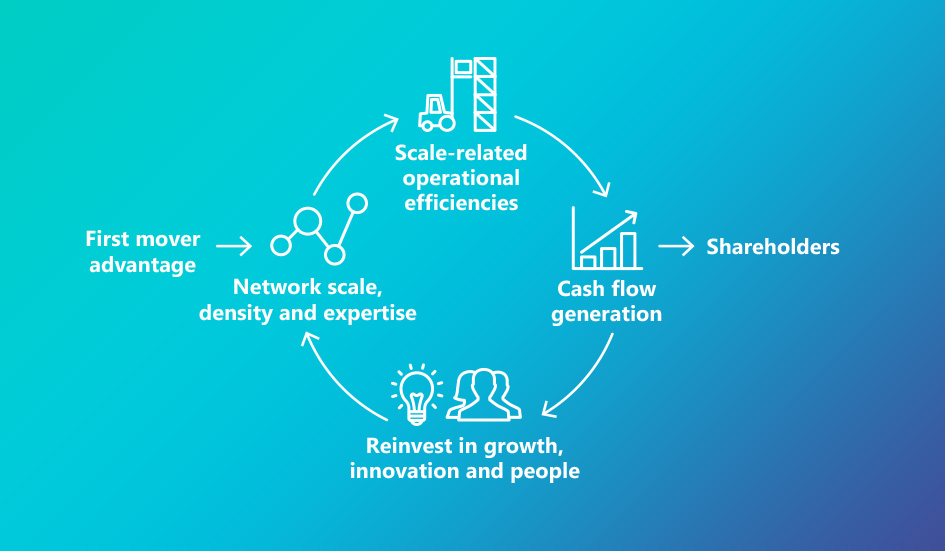

Brambles generates value through a circular ‘share and reuse’ model that leverages its scale,

density and expertise to achieve superior operational efficiencies.

These efficiencies in turn generate cash flow that can either be returned to shareholders or reinvested in the business to fund growth and to optimise and transform its operations to build a more resilient business.

Long-Term Value Creation and Sustainable Shareholder Returns

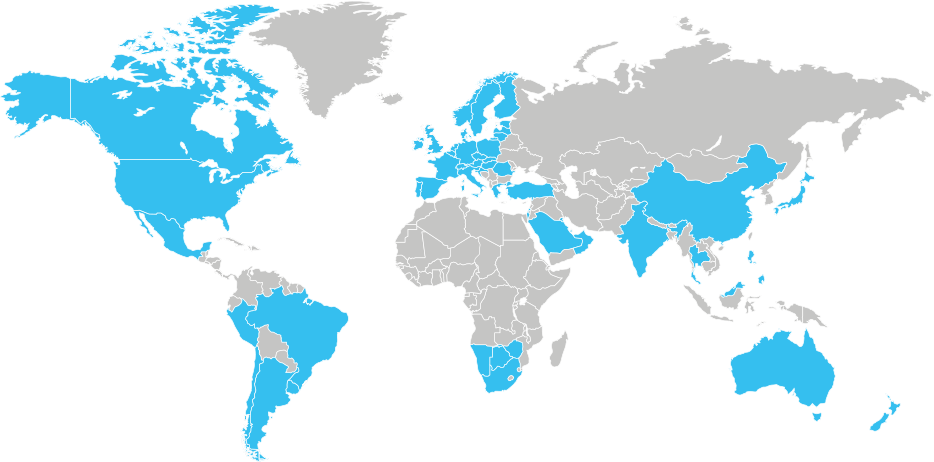

Brambles shares the efficiencies generated by its scale, density and expertise with its customers, providing a compelling value proposition compared to alternatives. By providing customers with supply chain solutions in approximately 60 countries, Brambles offers shareholders exposure to geographically diversified earning streams, primarily from the global consumer staples sector.

The supply chains served by Brambles also provide a broad range of growth opportunities including: increasing penetration of core equipment-pooling products and services in existing markets; diversifying the range of products and services; exploring the digitisation of supply chains; and providing a resilient foundation during supply chain uncertainties.

Within this context, Brambles is committed to striking the right balance between growing its business and delivering sustainable shareholder returns over the long term. By focusing on its core drivers of value, Brambles expects to deliver:

Sustainable growth at returns well in excess of the cost of capital

- Sales revenue growth2 in the mid-single digits;

- Underlying Profit growth2 in excess of sales revenue growth through the cycle; and

- Strong Return on Capital Invested.

2At constant-currency.

Cash generation to fund growth, innovation and shareholder returns

- Free Cash Flow sufficient to fully fund capital expenditure

and dividends.

Dividend Policy and Payment

Brambles’ dividend policy is to target a payout ratio of 45–60% of Underlying Profit after finance costs and tax, subject to Brambles’ cash requirements, with the dividend per share declared in US cents and converted and paid in Australian cents.

This year, the Board declared total dividends of 22.75 US cents per share with the Australian dollar payment equivalent to

32.31 Australian cents per share. This results in a payout ratio for the Year of 53%, broadly in line with the prior year’s payout ratio. FY21 total dividends were 20.5 US cents per share or equivalent to 27.32 Australian cents per share.

The final dividend for 2022 of 12.00 US cents per share is an 12% increase on the 2022 interim dividend of 10.75 US cents per share, and will be 35% franked. This dividend is payable in Australian dollars at 17.25 Australian cents per share. This represents an increase of 21% compared with the 2021 final dividend in Australian cents per share and reflects both earnings growth and reduction of shares on issue. The 2022 final dividend will be paid on 13 October 2022 to shareholders on the Brambles register at 5.00pm on

8 September 2022. The ex-dividend date is 7 September 2022.

Capital Management Programme

In FY19, Brambles announced that it intended to use the US$2.4 billion net proceeds from the divestment of the IFCO RPC business to pay down proportionate debt and fund a A$2.8 billion (US$1.95 billion) capital management programme.

The capital management programme comprised an on-market share buy-back of up to A$2.4 billion (US$1.67 billion) and a

A$0.4 billion (US$0.3 billion) pro-rata return of cash, equivalent to 29.0 AU cents per share.

The on-market share buy-back announced on 25 February 2019 was completed on 15 June 2022 with a total of 216.5 million ordinary shares purchased and cancelled.

Dividend Reinvestment Plan

Following the completion of the on-market share buy‑back programme, the Board is reinstating the DRP on a non‑underwritten basis. Shares under the DRP will not attract

a discount and the dilutive impact on earnings per share of the DRP will be neutralised. Eligible shareholders wishing to participate in the DRP should confirm their election status

before 5pm Sydney time on

Friday 9 September 2022 with Brambles Limited's Share Registrar, Boardroom Pty Limited.