Corporate actions

The LeanLogistics business, previously recognised in the Pallets Americas segment, was sold on 31 May 2016. LeanLogistics’ FY16 results are included in discontinued operations and prior year comparatives for Pallets Americas have been restated.

Sales Revenue

Sales revenue in Pallets Americas was US$2,427.8 million, up 4% (up 8% at constant currency), reflecting strong net new business wins and solid pricing and like-for-like volume growth.

North America sales revenue was US$2,186.1 million, up 6% (up 7% in constant currency). Net new business wins in the pooled pallet operations contributed 3% constant-currency growth, reflecting strong progress with the market segmentation strategy in the region. This strategy delivered a number of key wins in the protein and pharmaceutical sectors and the conversion of a large number of smaller customers in the US grocery sector from disposable “white-wood“ alternatives. Like-for-like volume growth contributed 1% of constant-currency growth, while price and sales mix improved in all business units.

Within North America:

Latin America sales revenue was US$241.7 million, down 8%. Constant-currency growth of 14%, was largely driven by strong like-for-like volume growth in Mexico, in line with improved economic conditions, and solid pricing growth, consistent with the inflationary environment in the region.

Profit

Underlying Profit was US$428.1 million, up 3% (up 8% in constant currency), reflecting a very strong profit performance in pooled pallet operations which more than offset operating challenges in the North American recycled pallet business.

Americas pooled pallet businesses (excluding North American recycled pallet business) delivered constant-currency Underlying Profit growth of 14%, reflecting strong volume, price and sales mix benefits and supply-chain efficiencies. Collectively, these benefits were more than sufficient to offset increases in direct costs in the period. On a constant-currency basis:

-

Net plant costs increased by US$19 million, reflecting cost inflation pressures, particularly in Latin America in line with the broader inflationary environment in that region. US pallet durability measures had a net-neutral impact on plant costs in FY16 and are expected to deliver damage rate and cost benefits from FY17 onwards;

-

Depreciation expense increased by US$15 million, in line with investment in the pallet pool to support expansion with new and existing customers; and

-

Net transport costs increased by US$12 million with US third-party freight inflation moderating during FY16. Continued improvements in asset management and a reduction in the fuel surcharge also contributed to higher transportation costs.

Underlying Profit in the North American recycled pallet business declined by US$25 million reflecting pallet core-price inflation, lower volumes, increased indirect costs and other one-off adjustments.

Operating profit of US$415.5 million was up 3% (up 8% at constant currency). Significant Items of US$12.6 million primarily related to the One Better program and the first phase of the CHEP brand refresh project.

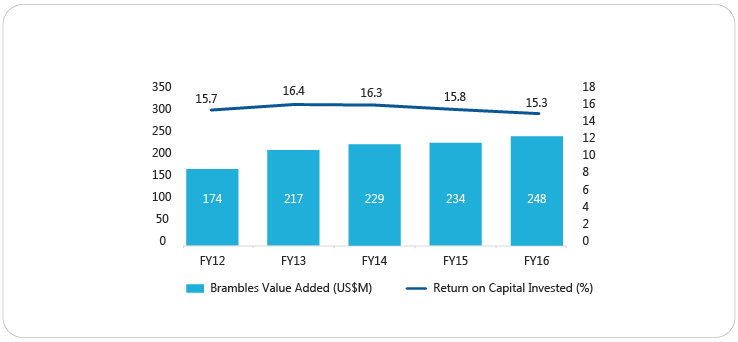

Return on Capital

Return on Capital Invested was 18.1%, down 0.3 percentage points (down 0.1 percentage points at constant currency), reflecting increased Average Capital Invested and the decline in Underlying Profit contribution from the North American recycled pallet business.

Return on Capital Invested for the Americas pooled pallet businesses (excluding the North American recycled pallet business) was 21.5%, up 1.1 percentage points at constant currency.

Capital expenditure was US$449.8 million, up US$71.4 million, driven by investment to support strong sales volume growth in the pooled pallet businesses, replenish US plant-stock levels and manage the impact of increased cycle times associated with increased inventory levels in the US retail supply chain.