Brambles Limited is a supply-chain logistics company operating primarily through the CHEP and IFCO brands. Brambles is listed on the Australian Securities Exchange (ASX) and has its headquarters in Sydney, Australia, but operates in more than 60 countries, with its largest operations in North America and Western Europe.

Brambles primarily serves customers in the fast-moving consumer goods (e.g. dry food, grocery, and health and personal care), fresh produce, beverage, retail and general manufacturing industries, counting many of the world's best-known brands among its customers.

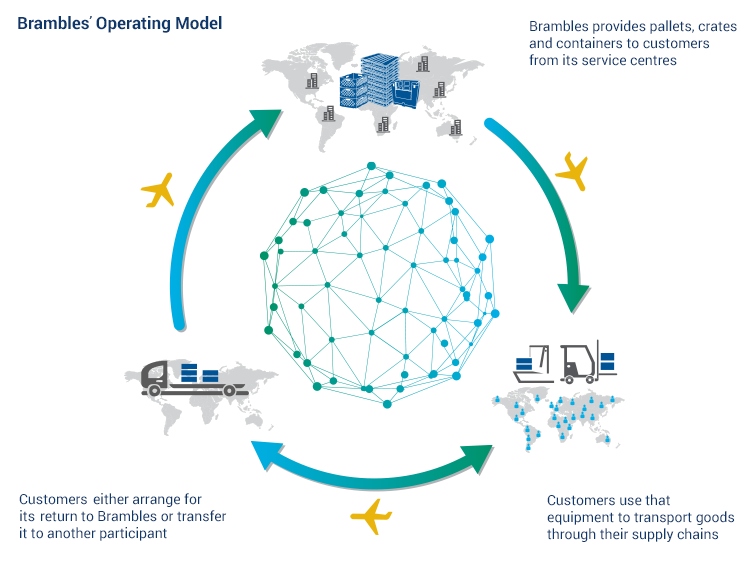

Brambles provides supply-chain logistics services to these customers, based upon the Group's longstanding expertise in the management of reusable unit-load equipment such as pallets, crates and containers. The Group also operates specialist container logistics businesses serving the automotive, aerospace and oil and gas sectors.

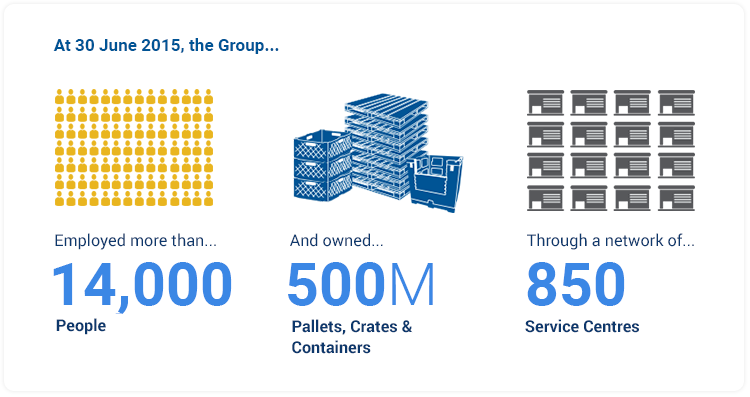

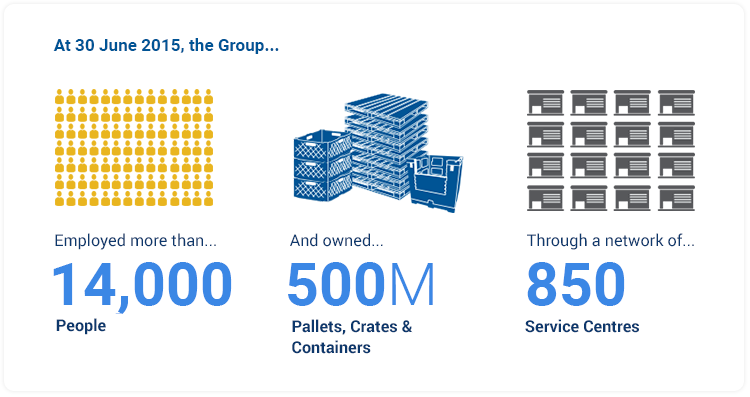

At 30 June 2015, the Group employed more than 14,000 people and owned more than 500 million pallets, crates and containers (before provisions) through a network of approximately 850 service centres.

For financial reporting purposes, Brambles is grouped into three segments:

-

Pallets, primarily serving the fast-moving consumer goods (e.g. dry food grocery, and health and personal care), fresh produce and beverage industries, and sub-divided into three regions:

-

Americas (comprising the CHEP pooled pallet operations throughout that region, the recycled pallet management operations in North America, and LeanLogistics, a transport management software business operating globally);

-

Europe, Middle East & Africa (comprising the CHEP pallet-pooling operations in those regions, as well as India); and

-

Asia-Pacific (comprising the CHEP pallet-pooling operations in that region);

-

RPCs (an acronym for Reusable Plastic or Produce Crates), serving the fresh produce and broader food industry and comprising the IFCO RPC pooling business worldwide and the CHEP RPC pooling businesses in Australia, New Zealand and South Africa; and

-

Containers, comprising four distinct business units:

-

Automotive, serving the automotive manufacturing industry;

-

IBCs, primarily serving customers transporting raw materials in the food and general manufacturing industries using intermediate bulk containers (IBCs);

-

Oil & Gas, comprising Ferguson Group, a provider of container management solutions to the offshore oil and gas industry, and CHEP Catalyst & Chemical Containers, which rents containers and provides associated services in the refining sector; and

-

Aerospace, which rents containers and pallets for the transportation of baggage and cargo to airlines, as well as maintaining these and other equipment.

Commentary on the performance of Brambles' operating segments during the Year, is included in Section 7 of this Operating & Financial Review.