Annual Review 2014

Annual Review 2014

1. About Brambles

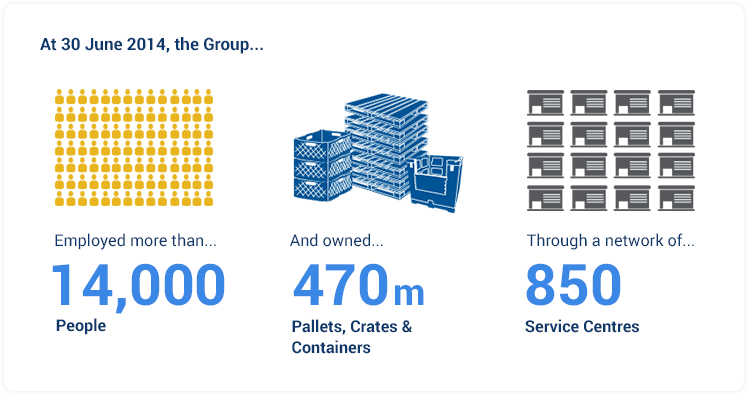

Brambles Limited is a supply-chain logistics company operating in more than 50 countries, primarily through the CHEP and IFCO brands. Brambles is listed on the Australian Securities Exchange (ASX) and has its headquarters in Sydney, Australia.

The Group specialises in the pooling of unit-load equipment and the provision of associated services, focussing on the outsourced management of returnable pallets, crates and containers. Brambles predominantly serves the consumer goods, dry grocery, fresh food, retail and general manufacturing industries. In addition, the Group has specialist businesses serving the automotive manufacturing, aerospace and refining sectors.

The Group is managed through three operating segments:

Pallets

Pallets, primarily serving the fast-moving consumer goods, grocery, food and general manufacturing industries and sub-divided into three regions: Americas (comprising the CHEP pallet-pooling operations in that region, the IFCO Pallet Management Services business in the USA and the global LeanLogistics business); Europe, Middle East & Africa (comprising the CHEP pallet-pooling operations in those regions); and Asia-Pacific (comprising the CHEP pallet-pooling operations in that regions);

Reusable Plastic Crates

Reusable Produce Crates (RPCs), serving the fresh produce industry and comprising the IFCO RPC pooling business worldwide and the CHEP RPC pooling businesses in Australian, New Zealand and South Africa; and

Containers

Containers, comprising four business units: CHEP Pallecon Solutions, primarily serving customers transporting raw materials in the food and general manufacturing industries; CHEP Automotive Solutions, serving the automotive manufacturing industry; CHEP Aerospace Solutions, which rents containers and pallets for the transportation of baggage and cargo to airlines, as well as maintaining these and other equipment; and CHEP Catalyst & Chemical Containers, which rents containers and provides associated services in the refining sector.

Commentary on the performance of Brambles operating segments during the Year, is included in Section 7.2 of this Operating & Financial Review.

Brambles enhances supply chain performance for customers by helping them transport goods through their supply chains more efficiently, sustainably and safely.

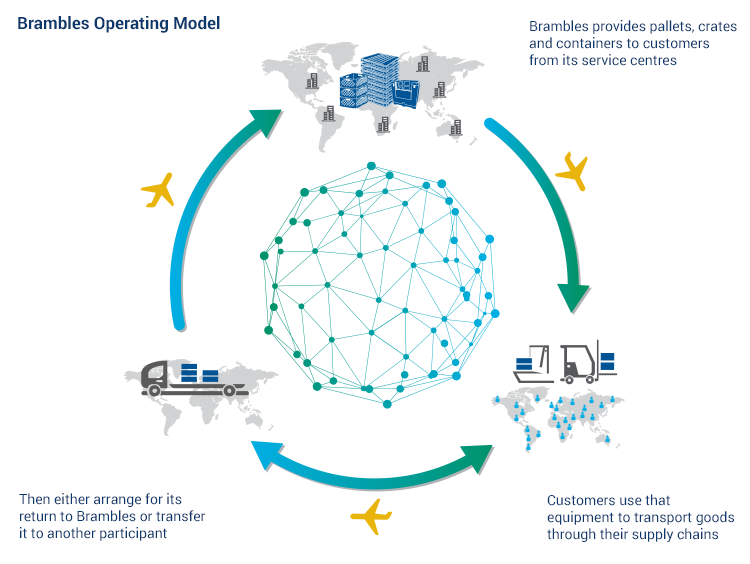

Brambles provides standardised reusable pallets, crates and containers to customers from its service centres, as and when customers require. Customers use that equipment to transport goods through their supply chains, then either arrange for its return to Brambles or transfer it to another participant in the network for that participant to use.

Customers eliminate the need to purchase and manage their own pallets, crates and/or containers by participating in Brambles’ pooling system. Customers benefit from the scale efficiencies generated by Brambles’ network and systems, as well as the Group’s asset management knowledge and continuous development of innovative solutions.

Brambles retains ownership of its equipment at all times, inspecting and repairing it as required to maintain consistent levels of quality. Brambles generates sales revenue predominantly from the rental and other service fees that customers pay based on their usage of the Group’s equipment.

Brambles’ shared values are articulated in Brambles’ Code of Conduct and are a core component of the Group’s culture:

Brambles’ intention is to create superior and sustainable value for its customers, shareholders and employees.

The Group implements its strategy under four key themes:

The service and value Brambles provides its customers, the quality of its relationships and the scale of its networks and invested capital base create the foundation of sustainable competitive advantage that supports the Group’s value proposition to investors.

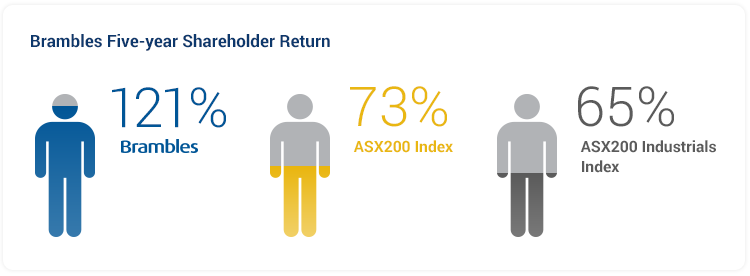

As a result of this value proposition, over the five years to 30 June 2014, Brambles consistently delivered profitable growth comprising superior rates of sales revenue growth and high levels of return on capital relative to the benchmark Australian share index, the S&P/ASX200 Index. Based on data published by Bloomberg for the five years ended 31 December 2013: Brambles’ compound average growth rate in sales revenue was 9%, compared with (2)% for the S&P/ASX200 Index; Brambles’ five-year average post-tax return on capital was 14%, compared with 5% for the ASX200.The Group has delivered superior total shareholder return over a one-year, three-year and five-year period compared with both the benchmark index and the relevant sector index, the S&P/ASX200 Industrials Index1.

1 Based on Bloomberg data, Brambles’ total shareholder return to 30 June 2014 (including the contribution of Recall Holdings Limited shares since the demerger in December 2013) was: 24% over one year (compared with 20% for the ASX200 and 19% for the ASX200 Industrials); 68% over three years (35% for the ASX200; 28% for the ASX200 Industrials); and 122% over five years (73% for the ASX200; 65% for the ASX200 Industrials).

In December 2013, Brambles communicated the following five-year objectives, reflecting the Group’s objective for the sustained delivery of its value proposition to investors through continued profitable growth:

-

Annual percentage sales revenue growth in the high single digits (i.e. on average, between 7% and 9%), at constant-currency2; and

-

Consistent incremental improvement in Return on Capital Invested to at least 20% by the end of FY19.

The Group is committed to continuing to focus on and invest in the aspects of its business that underpin its fundamental proposition to all stakeholders, including product service and quality and the efficient management and control of its assets.

In addition, as a result of the under-penetrated nature of equipment pooling in many sectors and regions of the global economy, the Group has access to a broad range of opportunities to continue to pursue profitable growth through applying its intellectual property to additional supply chains.

These opportunities include: increasing penetration with the Group’s core products and services in existing markets; diversifying the range of equipment pooling products and services; entering new and adjacent parts of the supply chain in which asset pooling can be applied; and expanding into new geographies.

The principal factors that define growth opportunities within which the Group can create value for customers while supporting its investment proposition for shareholders are:

-

Multiple parties use a common asset (i.e. a pallet, crate or container) to transport goods throughout the supply chain;

-

Assets flow freely and at high velocity throughout the supply chain, creating complexity that Brambles can manage more effectively through a pooled environment than customers could alone;

-

Ownership of assets is not a source of competitive differentiation to the asset user; and

-

Pooling of assets can create a benefit in which all supply-chain participants can share.

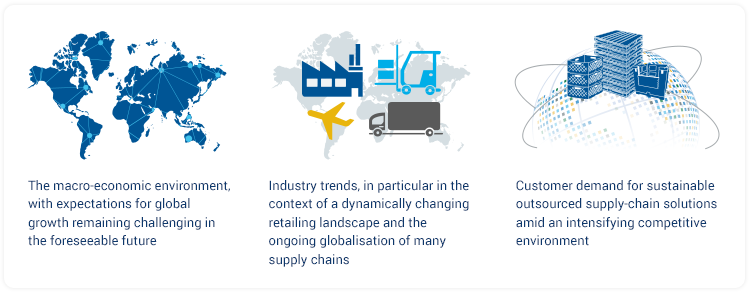

Brambles has identified the key external factors that influence its assumptions and targets and create areas of opportunity and risk as:

The Strategy Scorecard on Page 14 sets out the Group’s progress in relation to delivering its business strategy in the context of its objectives. This scorecard highlights short-term focus areas as well as execution risks and associated mitigating actions. Further details of Brambles’ risk management framework are provided under Significant Risk & Uncertainties in Section 4.0 of this Operating & Financial Review. Details in relation to how the Group uses its Remuneration Policy to incentivise the Company’s leadership to deliver profitable growth in the context of these factors are in the Remuneration Report on Pages 33 to 50.

2 Calculated by translating reported period results into US dollars at the actual monthly exchange rates applicable in the prior corresponding period.

The Group monitors performance and value creation through non-financial metrics (such as customer loyalty, safety performance and employee engagement and enablement) and through financial metrics (such as those covering sales revenue, profitability, return on capital and shareholder returns).

There are three key drivers of Brambles’ sales revenue growth:

-

General increases in sales volumes in line with economic or industry trends (a relatively stable variable because the majority of Brambles’ sales revenue comes from customers in the consumer staples sector);

-

The rate at which the group expands the penetration of its operations (often described as “net new business wins”); and

-

Movements in pricing.

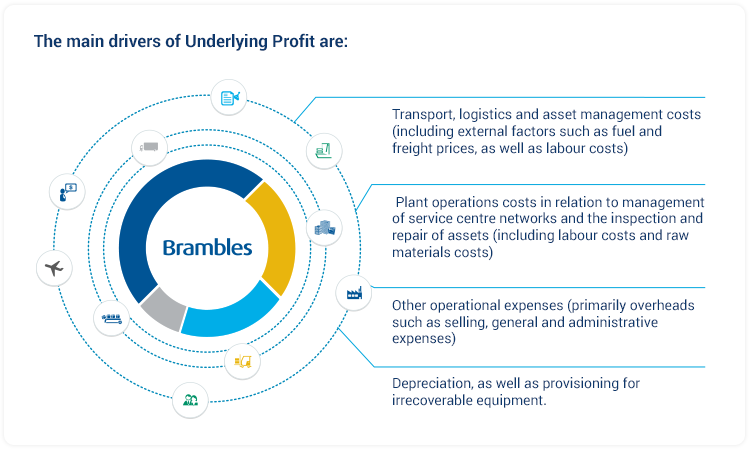

Brambles’ key profit metric is Underlying Profit, which is adjusted from statutory operating profit by removing significant items.

Brambles calculates Return on Capital Invested by dividing Underlying Profit by Average Capital Invested . The main driver of Average Capital Invested is capital expenditure on pooling equipment. The main drivers of capital expenditure are the rate of sales growth as well as asset efficiency factors: i.e. the amount of pooling equipment not recoverable or repairable each year (and therefore requiring replacement) and the frequency with which customers return or exchange pooling equipment. Brambles’ main capital cost exposures are for raw materials, primarily lumber and plastic resin.

The Group also monitors Brambles Value Added, which measures value generated over and above the cost of capital used to generate that value. Brambles Value Added is calculated by subtracting from Underlying Profit the product of Average Capital Invested multiplied by 12% (a notional representation of pre-tax cost of capital).Details of the Group’s performance relative to these metrics are included in Section 7.0 of this Operating & Financial Review.